Mortgage Advice to possess Home owners Impacted by COVID-19

The fresh new Virginia Financial Rescue System provides financial assistance to get rid of financial delinquencies, defaults , and foreclosure to own property owners experiencing financial difficulties due to the pandemic. Eligible people for the Virginia can use for the majority of of your $258 mil the official acquired included in the Western Save Plan Act to pay overdue mortgage repayments, homeowners’ insurance coverage, flood insurance, home loan insurance , homeowners’ connection costs, and assets fees.

For those who default on your financial repayments for the Virginia, the fresh servicer (on behalf of the mortgage manager, known as “lender” in this article) will ultimately begin brand new property foreclosure procedure. The method will likely feel nonjudicial, although judicial foreclosure also are greeting.

Virginia law specifies exactly how nonjudicial steps works, and you can both state and federal rules give you rights and you will defenses regarding foreclosures.

Mortgage loans in the Virginia

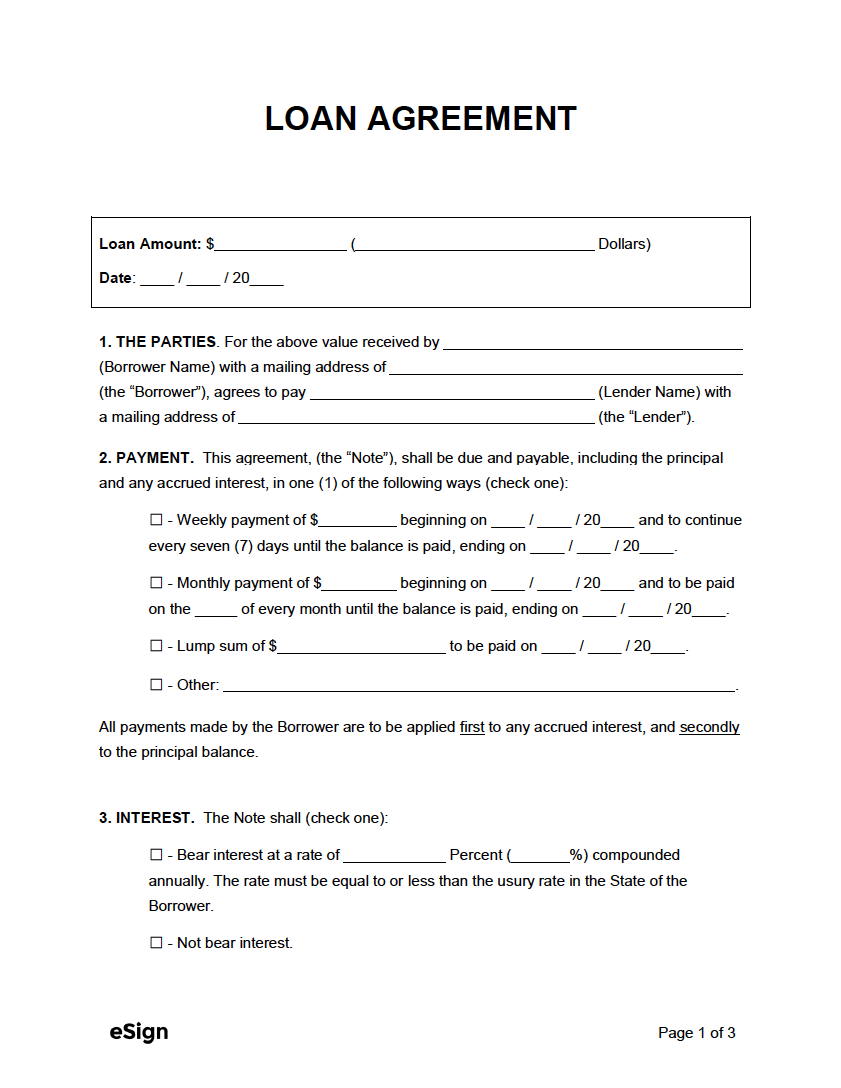

Should you get a loan to order home-based real estate for the Virginia, you will probably signal two documents: a beneficial promissory note and you can an action out-of believe. The fresh new promissory notice ‘s the file that has had their vow so you can pay the mortgage also the repayment words. This new deed from trust, that’s nearly the same as home financing, is the document providing you with the financial institution a security need for the house or property and certainly will most likely were an electrical power out of sale term.

If you can’t improve money, the power of sale term gives the lender the right to offer your house nonjudicially this normally recover the cash they loaned your.

What will happen for those who Skip a home loan Fee

If you miss a payment, the brand new servicer can usually fees a late payment after the sophistication period ends. Really mortgages give a grace age of 10 to 15 months, eg, in advance of it is possible to incur late charge. To determine the latest grace several months on the condition and the amount of new later percentage, feedback brand new promissory notice or your own monthly charging you report.

For those who skip several home loan repayments, new servicer will probably publish emails and you may name one to are to gather. Government home loan servicing regulations need the servicer to make contact with your (otherwise you will need to get in touch with your) from the cellular telephone to discuss foreclosure solutions-titled “losings minimization” options-no later than just thirty-six weeks once a skipped payment and you can again within payday loan Ridgway this 36 weeks after each after the missed percentage. (twelve C.F.Roentgen. ).

Only about forty-five days after a skipped percentage, the fresh new servicer need to inform you on paper regarding the losses minimization choice that could be offered, and you can assign professionals in order to. Some exclusions for some of these standards can be found, eg for individuals who file for bankruptcy otherwise give this new servicer maybe not to contact you beneath the Fair Debt collection Means Act. (twelve C.F.R. ).

What is actually a breach Page?

Of many deeds regarding have confidence in Virginia possess a supply that needs the financial institution to deliver a breach page for individuals who fall behind for the money. That it observe informs you your mortgage is during standard.

If not eradicate the fresh new default, the lending company is also accelerate the mortgage (call-it due) and proceed with the foreclosures.

Whenever Do Property foreclosure Begin?

Government law generally necessitates the servicer to attend until the mortgage is over 120 days outstanding just before commercially performing a foreclosures. However, in some affairs, including for individuals who violate a due-on-sales clause or if the brand new servicer is actually joining this new property foreclosure action of an excellent or under lienholder, the latest foreclosures will start ultimately. (a dozen C.F.R. ).

County Property foreclosure Legislation into the Virginia

Again, very Virginia foreclosures try nonjudicial. Virginia rules has no need for a loan provider to complete much to complete an out-of-legal foreclosure. The minimal steps necessary become: delivering your you to definitely find and you may publishing an alerts of your sales for the a paper.